The Covid-19 pandemic led to a sharp fall in EU27+UK imports of wood products from VPA Partners and other tropical countries during 2020, although the immediate effects were concentrated in the second quarter of the year and varied widely between product groups and countries. The downturn in 2020 also followed on from a significant rise in trade in 2018 and 2019 and the overall effect was to reduce trade to the level of two years before. The early signs are that the COVID downturn in EU27+UK tropical wood imports will be less dramatic, and more short-lived, than the downturn following the financial crises in 2008-2009 which effectively halved the size of the trade over the long term.

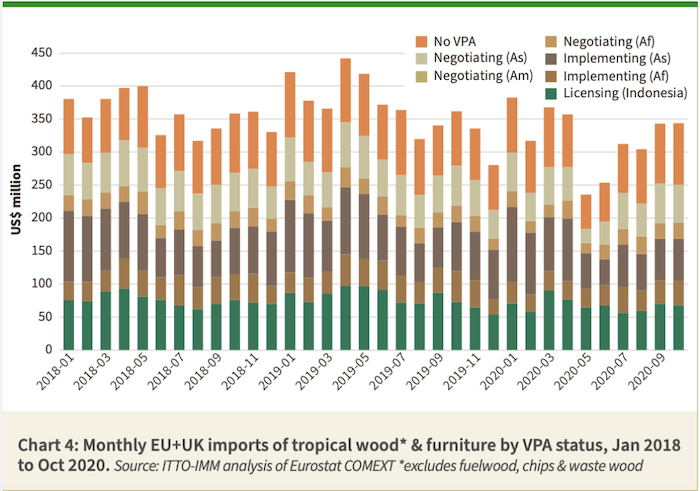

Chart 4 shows that while EU27+UK imports of tropical wood and wood furniture products fell sharply in May and June last year, there was a strong rebound in July. Although imports declined again in August, they were still quite high in a month which is traditionally very slow during the European summer vacation period, and then recovered well in September and October. During the summer and autumn last year, EU27+UK imports were given a boost by easing of lockdown measures, good demand in the DIY sector, and the relative strength of the euro on international exchange markets, the euro-dollar rate rising sharply from a low of 1.06 in March to 1.22 by the end of the year. The dollar’s weakness was due to political uncertainty during and after the presidential elections and the continuing severity of the pandemic in the United States.

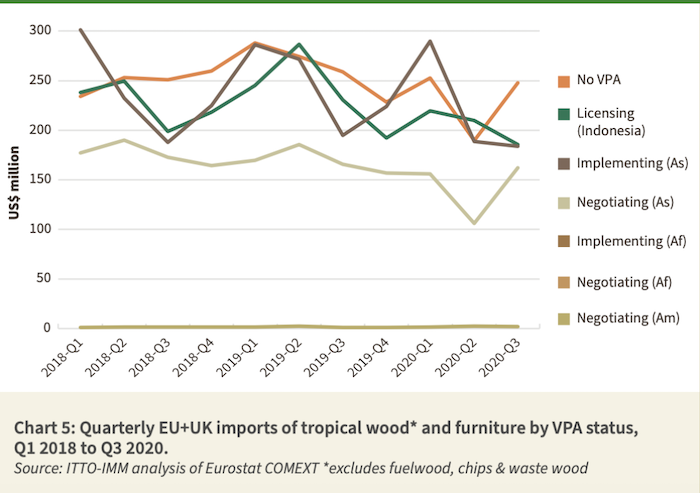

Chart 5 highlights that while there was no sharp dip in EU27+UK imports of Indonesian FLEGT Licensed products in the second quarter of 2020, the first lockdown period coincided with a time of year when trade with Indonesia is typically quite strong. There was also no compensating uptick in imports from Indonesia in the third quarter when lockdown measures were eased. Exporters in Viet Nam, the only VPA implementing country in Asia, were slightly more fortunate in the sense that the first lockdown period came at a time of year when European imports from Viet Nam typically decline (most usually arrive in the first quarter). However, the second quarter fall in imports from Viet Nam in 2020 was particularly sharp and, as with Indonesia, there was no rise in the third quarter to offset the decline. EU27+UK imports from VPA negotiating countries in Asia, led by Malaysia, also fell rapidly in the second quarter of last year, but made more of a recovery in the third quarter.

EU27+UK imports from VPA implementing and negotiating countries in Africa stand out for their relative stability in 2020, all the more surprising as the African timber trade is usually quite volatile. The data indicates that the African trade was less affected by COVID-related supply side problems than other regions in 2020. This trade was particularly buoyed by the continuing stability of EU imports from Gabon, notably of veneers destined for France.

Tropical wood and wood furniture imports into the EU+UK from countries not engaged in the VPA process fell sharply in the second quarter last year but also rebounded strongly in the third quarter. Imports of furniture from India fell particularly rapidly in the second quarter but were showing signs of recovery in the third quarter. Imports of tropical sawn hardwood and decking from Brazil, and of tropical hardwood plywood from China, began to fall in the second half of 2019 well before the pandemic impacted on the market, and the downward trend accelerated during the lockdown period. However, imports from both countries showed signs of recovery in the third quarter last year. Imports of sawnwood also continued to rise from Ecuador throughout 2020, driven mainly by demand for balsa wood for manufacture of wind turbines, particularly in Denmark and Germany.

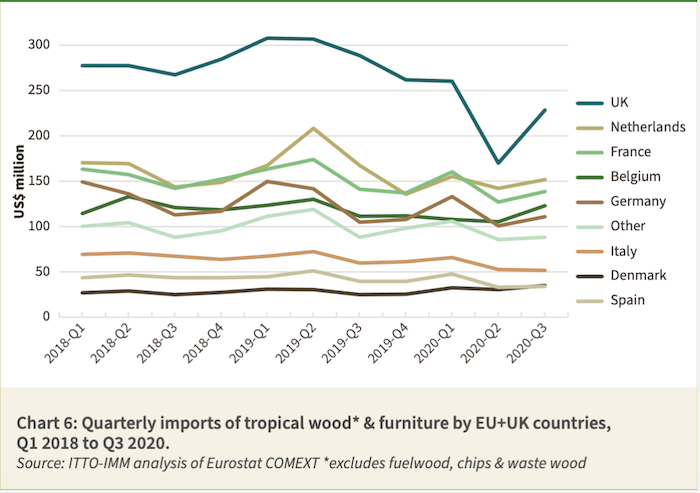

Chart 6 highlights that while imports of tropical wood and wood furniture products fell in all the largest European markets in the second quarter of 2020 and rebounded in the third quarter, these trends were much more pronounced in the UK than other countries. The higher level of volatility in the UK seems indicative of extreme levels of market uncertainty in a country hit particularly hard by the first wave of the pandemic, while at the same time dealing with the fallout from Brexit. The UK’s relatively high level of dependence on trade with China and Viet Nam, where there was particularly serious disruption to supply chains early on the pandemic, also contributed to the extra trade volatility.

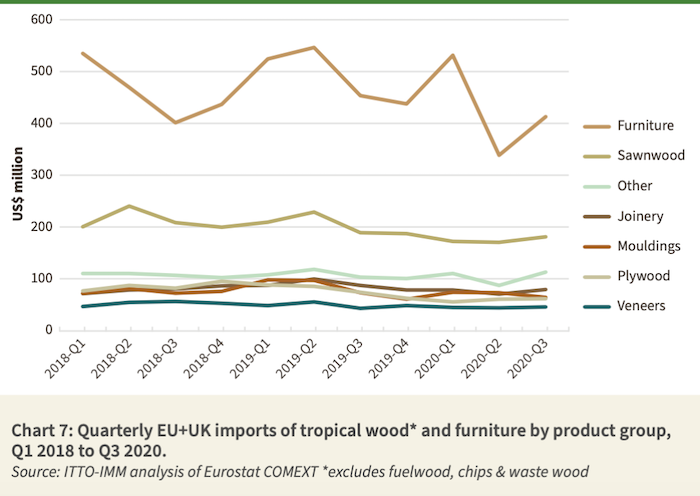

Chart 7 shows that the downturn in EU27+UK imports of tropical wood products in the second quarter of 2020 and the rebound in the third quarter was concentrated mainly in furniture. However, it also shows that the level of quarterly volatility in the EU+UK tropical furniture trade last year was not significantly different to the previous two years. The impact of the 2020 lockdown barely registers in total EU+UK trade in tropical sawnwood, joinery, mouldings, plywood and veneer.

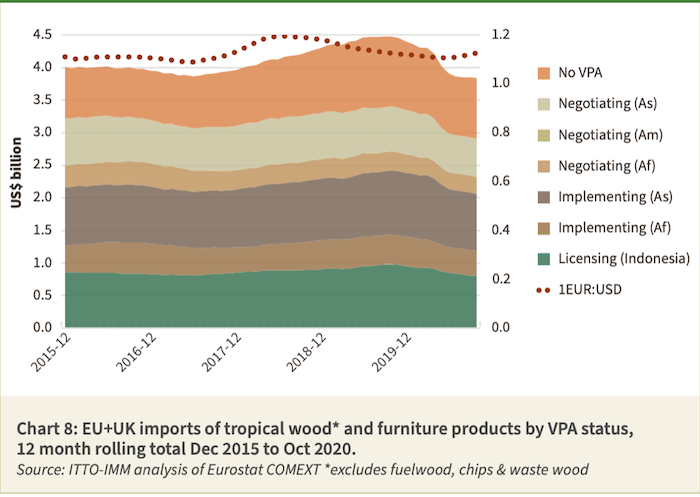

Recent decline in EU27+UK tropical wood imports predates the pandemic. Chart 8 puts into long term context the impact of the COVID-19 on the EU27+UK tropical wood and wood furniture trade in 2020. It shows twelve monthly rolling total US$ value of imports to iron out short-term seasonal changes and fluctuations during lockdowns. This highlights that the decline in EU27+UK imports from VPA partners and other tropical countries predated the pandemic. After hitting a high of US$4.48 billion in October 2019, the 12-month rolling total had already fallen to US$4.30 billion in February last year.

All the EU’s largest economies deteriorated at the end of 2019 and in the first quarter of 2020. Total EU GDP increased only 0.2% between September and December 2019 and fell 3.3% in the first quarter of 2020. Various factors contributed, including continued Brexit uncertainty, slumping global trade, which hit European exports, widespread strikes in France over President Macron’s pension reforms, and weaker domestic demand for goods and services in Italy, alongside continuing political difficulties. During this period, the euro was weakening against the US dollar, eroding the purchasing power of European importers.

Then the pandemic hit leading to widespread lockdowns and the 11.3% decline in EU GDP and 19.8% decline in UK GDP. The 12-month rolling total of EU27+UK tropical wood and furniture imports fell rapidly from US$4.30 billion in March to US$3.92 in June before stabilising at around US$3.85 billion between July and October. In effect this takes the total value of trade back down to levels last seen in early 2017 before the recent uptick in 2018 and 2019.

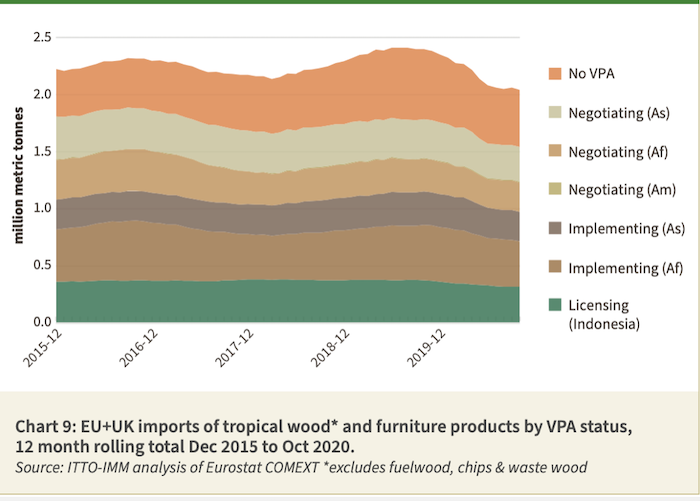

Chart 9 shows that the trend in import tonnage mirrors the US$ value trend, and so is not entirely exchange rate- driven, although the downturn after the first lockdowns in the spring is more pronounced in tonnage terms. The 12-month rolling total quantity of EU27+UK tropical wood and wood furniture imports fell from a peak of 2.41 million tonnes in August 2019 to 2.27 million tonnes in February 2020, just prior to the first lockdowns, and to 2.08 million tonnes by June. It then stabilised at around 2.05 million tonnes between July and October. In tonnage terms, these are levels last seen in early 2014 when the EU economy was at its lowest ebb during the eurozone debt crisis.