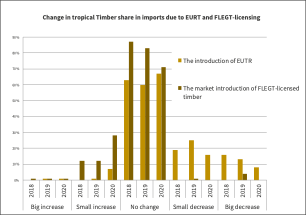

As a part of the IMM 2018-2020 EU trade surveys, respondents were asked whether FLEGT Licensing and the introduction of the EUTR had had any direct impact on the share of tropical timber in their overall timber imports. As demonstrated in figure 1, the number of companies reporting small increases in timber and timber product imports due to the market introduction of FLEGT-licensed timber rose sharply to 28% last year; this compares to 12% in both 2018 and 2019 (figure 1).

Respondents mentioned Indonesia gaining market share from South American and Malaysian suppliers, for example. 71% reported “no change” and there were no companies reporting decline in tropical timber imports due to FLEGT-licensing in 2020.

Figure 1: Impact of EUTR and FLEGT licensing on tropical timber imports

EUTR direct impact on EU tropical timber procurement levelling off

A contrasting trend was recorded for EUTR, where only a very small number of respondents reported increases but quite a large proportion in each year flagged up decline. However, the number of respondents reporting either small or big decreases in the share of tropical timber in their overall timber imports due to introduction of EUTR fell from 35% in 2018 and 38% in 2019 to 24% in 2020 (figure 1).

67% in 2020 said there was no change and 8% reported increasing purchases of tropical timber due to introduction of EUTR. No respondents in 2018 and just 2% of respondents in 2019 said their imports of tropical timber had increased as a result of EUTR. 2020 respondents who noted an increase said that some of their clients’ trust in the legality of tropical timber and timber products had grown and their demand increased due to EUTR.

Survey respondents reporting negative impacts indicated that EUTR due diligence had narrowed their supply base in tropical countries. An increasing concentration of tropical timber and timber product import trade in the hands of “specialist” exporters and importers was also noted. This means that overall volumes produced and traded are not necessarily declining, but the number of companies involved in trade is, with larger companies typically taking over from smaller competitors.

Respondents also indicated that EUTR had caused the sector to reconsider its supply chain relationships, which sometimes resulted in increasing substitution of tropical hardwoods with alternatives, including temperate hardwoods and chemically or thermally modified timber as a result of EUTR.

This last point was further intensified by companies focusing on certified timber only or increasing percentages of certified timber in their overall purchases – sometimes as a part of EUTR due diligence and sometimes independently of EUTR. Several respondents replaced tropical timber with temperate species or other substitutes in the process of buying more certified product, which is at least partly due to a lack of supply of certified tropical timber.